Got roof damage? You’re not alone—and you’re not out of options.

In fact, in Charlotte’s hot real estate market, homes with less-than-perfect roofs change hands all the time. But make no mistake: how you choose to sell your roof-damaged property will shape everything—from how fast you sell to how much you walk away with.

The good news? You’ve got four solid paths forward.

This post will break down each one in detail, including:

- The pros and cons of repairing versus selling as-is

- What you legally must disclose in North Carolina

- How to attract the right buyer for your situation (and avoid time-wasters)

- And a few expert tips to help you sell smart—even if your roof’s seen better days

Let’s start with the classic approach: fixing the problem head-on.

II. Option 1: Repair the Roof Before Listing

Sometimes the cleanest way to get top dollar is also the most obvious: fix the roof before your house hits the market.

Pros

- Boosts your home’s value. A roof in solid condition increases your asking price and gives appraisers fewer reasons to nitpick.

- Expands your buyer pool. Most traditional buyers are relying on mortgage financing—and lenders don’t love leaky ceilings.

- Smoother inspections. You’ll reduce the odds of a post-inspection panic attack (or a deal falling apart at the last second).

Cons

- It’s an investment. Roof repairs or replacements aren’t cheap—and not everyone has $8,000–$15,000 sitting around.

- It takes time. Depending on your contractor and materials, you could be looking at weeks before you’re even ready to list.

Carolina Home Cash Offer Tip:

Even if a full roof replacement isn’t in the cards, small upgrades matter. Replacing a few cracked shingles or resealing flashing can boost buyer confidence and make your listing photos pop.

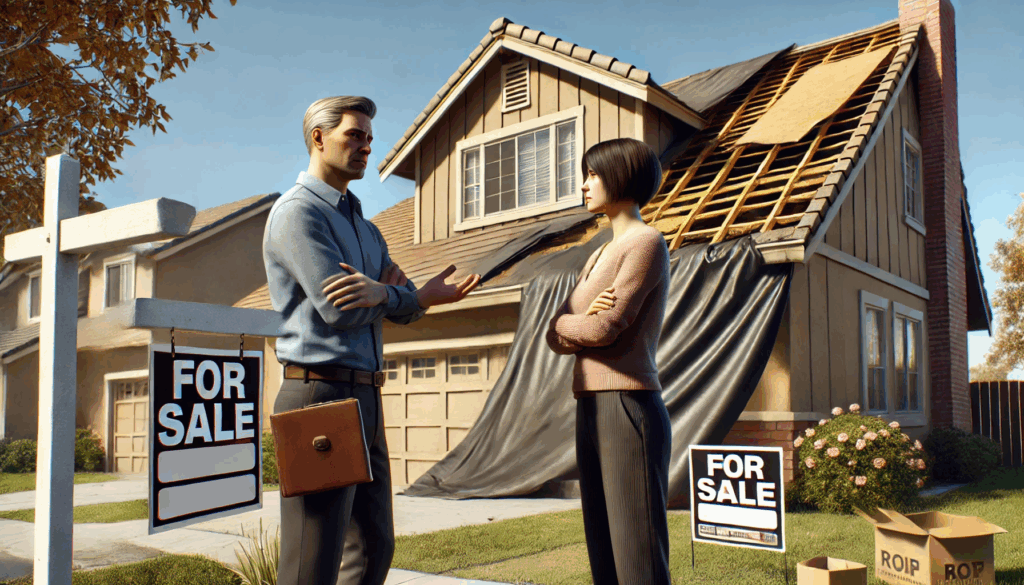

III. Option 2: Sell the House As-Is

If you don’t have the time, money, or energy to tackle roof repairs, selling your home as-is might be the most practical path. And in Charlotte, there’s a strong market for homes that need work—if you know where to look.

Pros

- Skip the repair drama. No contractors, no delays, no surprise costs.

- Ideal for cash buyers and investors. These buyers expect to handle repairs themselves and won’t run for the hills at the sight of a sagging roof.

- Close quickly. With no lender requirements or repair negotiations, a cash sale can be finalized in as little as 7–14 days.

The key? Find the right buyer.

That’s where Carolina Home Cash Offer comes in. We specialize in helping Charlotte homeowners sell homes with roof damage, foundation issues, hoarding situations—you name it. We’ll give you a fair cash offer, handle the paperwork, and close on your timeline.

Cons

- Lower offers. Expect offers in the range of 30–70% of your home’s fair market value, depending on condition and location.

- Smaller buyer pool. Traditional buyers using financing are usually off the table, since lenders won’t approve a loan on a house with significant roof damage.

Legal Note

Full disclosure isn’t optional in North Carolina. If your roof leaks, sags, or shows visible damage, you’re required to disclose it in the state’s Residential Property Disclosure Statement. If you fail to mention it, the buyer can walk—or worse, sue.

IV. Option 3: Negotiate With Buyers

If you’re not interested in fixing the roof yourself—but you also don’t want to take a deep discount—negotiating with buyers can be a smart middle ground. This approach allows you to keep the deal moving while giving buyers the freedom to handle repairs on their own terms.

A. Offer Repair Credits or Price Reduction

Instead of footing the bill upfront, you can offer buyers a credit at closing or reduce your asking price to account for the needed roof work. This strategy appeals to buyers who prefer choosing their own contractor, materials, and timing for repairs.

Why it works:

- You avoid the hassle and expense of doing the repairs yourself

- Buyers get flexibility and a sense of control

- The negotiation feels collaborative rather than confrontational

It’s a common approach, especially in a market like Charlotte, where savvy buyers are open to fixer-uppers—as long as the pricing reflects reality.

B. File an Insurance Claim

If your roof damage was caused by a recent event—such as hail, wind, or a fallen tree—your homeowner’s insurance may cover part or all of the repair costs. Filing a claim could give you the funds you need to repair the roof or offer a credit, all without dipping into your own pocket.

What to consider:

- Insurance claims typically require documentation and must be filed within a certain window of time after the damage

- If approved, this route can offset repair costs and make your home more attractive to buyers—without draining your savings

Either way, negotiating with buyers gives you options without forcing you into a full-blown renovation or a rock-bottom sale.

V. Option 4: Sell to a Cash Buyer or Investor

Sometimes, the fastest path forward is also the cleanest: cash out, walk away, and skip the chaos.

That’s exactly what Carolina Home Cash Offer is built for. We buy houses in any condition—including those with serious roof damage—and we do it without the stress of inspections, appraisals, or traditional financing.

Why this route makes sense for roof-damaged homes:

- No repairs required. You won’t have to patch a thing.

- No bank delays. Cash deals eliminate the financing wait.

- No deal-breaker inspections. We’ve seen it all, and we don’t scare easily.

Instead of waiting months for a buyer who might get loan approval, you can get a cash offer in 24 hours and close in as little as a week.

Best For:

- Sellers who need to move fast

- Properties that won’t qualify for a mortgage due to condition

- Owners who want a clean break—no repairs, no realtor fees, no listing stress

Carolina Home Cash Offer makes it simple: one call, one offer, one smooth close.

VI. Key Considerations Before You List

Before you make a move, there are a few important rules and realities to understand—especially if your roof is in rough shape.

1. Disclosure Rules in North Carolina

By law, you must disclose known roof damage in the Residential Property Disclosure Statement. Whether it’s a slow leak, visible sag, or damage from a past storm, it needs to be documented.

Omitting known issues can kill a deal—or land you in court.

2. Financing Barriers

Most lenders won’t approve mortgages for homes with major roof problems. That means traditional buyers may not even qualify to purchase your property, no matter how much they love it.

If you go the listing route, be prepared for inspection issues or financing fall-throughs—especially if your buyer is depending on a loan.

3. Charlotte Market Context

Here’s the silver lining: Charlotte’s real estate market is uniquely friendly to as-is sales. Nearly one-third of all transactions in the area are done in cash.

That means investors, flippers, and companies like Carolina Home Cash Offer are already looking for homes just like yours.

VII. Summary Table: Selling a Charlotte Home With Roof Damage

| Option | Pros | Cons | Best For |

| Repair Roof | Higher price, more buyers | Upfront cost, slower process | Sellers with time & funds |

| Sell As-Is | Fast, no repairs | Lower price, fewer buyers | Sellers who need speed |

| Credit/Reduction | Buyer flexibility | Negotiation required | Sellers with interested buyers |

| Cash Buyer | Simple, fast close | Lower offer | Sellers wanting a no-hassle sale |

This table lays it all out. Whether you’re aiming for max value or a fast exit, there’s a strategy that can work for your specific situation.

VIII. Final Thoughts: Your Roof Isn’t a Dealbreaker

Roof damage can feel like a heavy burden—but it doesn’t have to tank your sale.

The Charlotte market is filled with flexible buyers, cash investors, and experienced companies who know how to navigate homes that need work. And the smartest sellers? They lean into the strategy that fits their reality—not some HGTV fantasy.

So whether you’re ready to swing a hammer or just want to walk away with cash in hand, you’ve got real, actionable options.

Ready to explore selling your Charlotte home with roof damage? Let Carolina Home Cash Offer guide the way.

We’ll give you a fair, no-obligation offer—and handle the heavy lifting so you don’t have to.

Frequently Asked Questions (FAQ)

Can I legally sell my house in Charlotte with roof damage?

Yes—North Carolina allows you to sell a home in any condition, but you are legally required to disclose known issues like roof damage in the Residential Property Disclosure Statement. Full transparency is key to avoiding legal trouble or last-minute deal fallout.

Will a damaged roof prevent buyers from getting a mortgage?

In most cases, yes. Major roof issues are a red flag for lenders, who typically require the home to meet minimum property standards. That’s why cash buyers like Carolina Home Cash Offer are often the most realistic path for as-is sales.

What if I don’t know the full extent of the damage?

It’s okay if you’re not a roofer—but you still need to disclose what you do know. Obvious signs like leaks, sagging, or water stains should be mentioned. If you’re unsure, getting a roof inspection before listing can provide clarity—and help you decide which route to take.

How much do roof repairs usually cost in Charlotte?

Costs vary based on the size, materials, and extent of the damage, but a full roof replacement in Charlotte typically ranges from $8,000 to $15,000. Minor repairs could be just a few hundred bucks. Either way, it’s worth weighing the cost of repairs against your expected sale price.

How fast can I sell to a cash buyer like Carolina Home Cash Offer?

We can make you a fair cash offer within 24 hours and close in as little as 7 days, depending on your timeline. There are no appraisals, no lender delays, and no repair requirements—just a streamlined process that puts control back in your hands.

Will I still get a decent offer if I sell my house as-is?

You may not get full market value, but you’ll save big on repairs, realtor commissions, and holding costs. Carolina Home Cash Offer evaluates your home based on its current condition, location, and resale potential—and we aim to offer a deal that’s fair, fast, and hassle-free.